Indian Rupee Calculator for Travelers

Trip Duration

Select how long you'll be traveling in India

Travel Style

How much will you use local transportation?

Daily Budget (USD)

Estimate your daily spending

Emergency Fund (USD)

Amount to keep aside for emergencies

Recommended Rupee Amount

Click "Calculate Required Rupees" to see your personalized recommendation

- This calculation assumes you're using digital payments in cities and towns

- Carry small denominations (₹10, ₹20, ₹50) for local markets and small vendors

- Keep some cash hidden in different locations for security

- Consider a travel prepaid card as a backup option

Planning a trip to India often brings up a simple but crucial question: cash in India. Do you need to carry a wad of notes, or can you rely on cards and apps? This guide breaks down exactly where cash still matters, how digital payments work, and the safest way to keep money on hand while you explore the subcontinent.

Key Takeaways

- Carry enough Indian rupees for small towns, markets, and emergency situations.

- Use UPI apps and cards in metros, hotels, and popular tourist spots.

- Withdraw cash from ATMs that belong to major networks to avoid high fees.

- Exchange money at banks or authorized kiosks for the best rates.

- Consider a travel prepaid card for backup and smoother budgeting.

Understanding the Indian Rupee

When you hear the word "cash" in an Indian context, it refers to the Indian Rupee (INR), the official currency issued by the Reserve Bank of India. Coins come in 1, 2, 5, and 10 rupee denominations, while notes range from 10 to 2,000 rupees. The rupee’s symbol (₹) is widely recognized, and its denominations are printed with security features that make them hard to counterfeit.

Where Cash Still Rules

Even in 2025, many parts of India operate primarily on cash. Here are the most common scenarios where you’ll need rupees:

- Rural Areas: Small villages, agricultural markets, and remote guesthouses often accept only cash. Rural Areas regions where digital infrastructure is limited and merchants rely on physical currency.

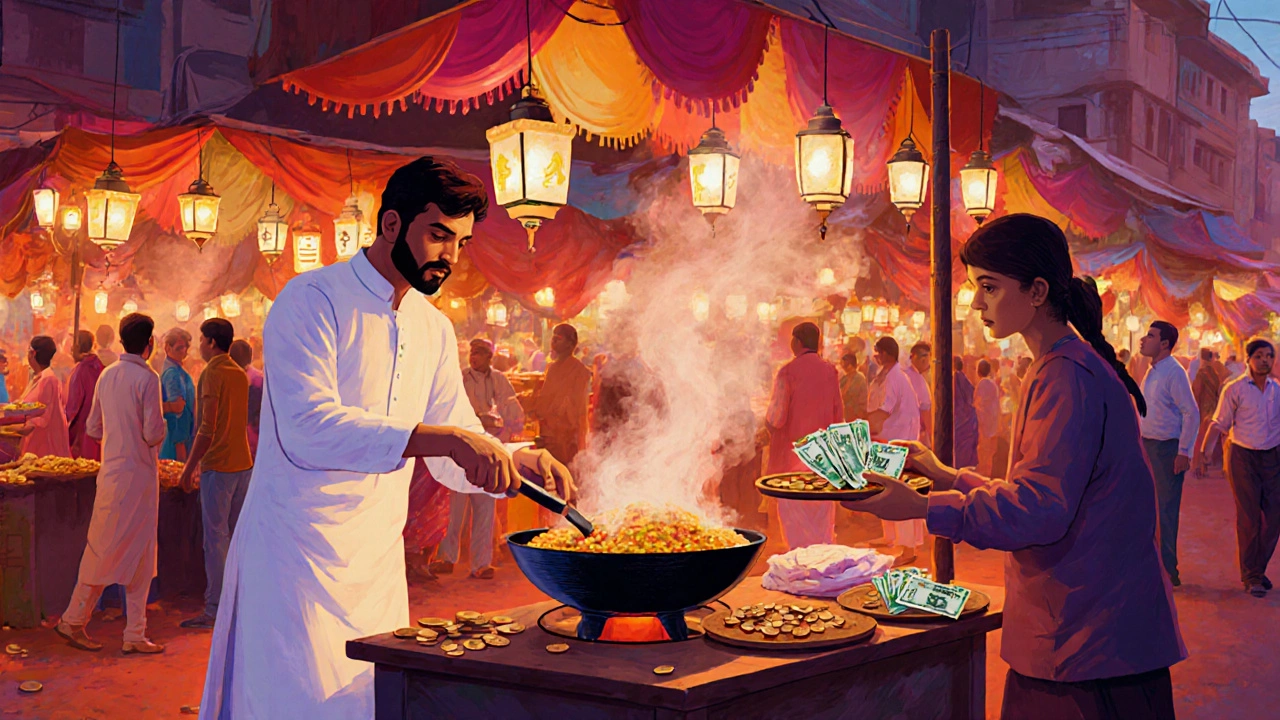

- Street Food and Local Markets: From chaats in Delhi’s Chandni Chowk to spices in Kolkata’s Bhowanipur market, vendors prefer notes and coins.

- Temples and Heritage Sites: Offerings and entry fees are commonly paid in cash; many accept only exact change.

- Transportation: Auto‑rickshaws, local buses, and some train ticket counters still ask for cash.

In these settings, having small denominations (10, 20, 50 rupees) smooths transactions and avoids the embarrassment of being refused.

Digital Payment Landscape

India’s digital payment ecosystem is one of the world’s most advanced. The two major pillars you’ll encounter are:

- Unified Payments Interface (UPI), a real‑time payment system that links bank accounts to mobile apps, enabling instant transfers via a virtual address. Apps like Google Pay, PhonePe, and Paytm are ubiquitous in cities.

- Mobile Wallets, digital accounts that store funds for quick payments, often linked to a debit or credit card. They are accepted at malls, upscale restaurants, and online bookings.

Cards (Visa, Mastercard, RuPay) also work well in hotels, airlines, and larger retailers. However, keep in mind that some merchants set a minimum transaction amount for card use, typically 500 rupees.

ATM Access and Fees

India’s ATM network is extensive in urban centers. The main providers are State Bank of India (SBI), HDFC, ICICI, and Axis Bank. When you use an international card, consider these tips:

- Choose ATMs that belong to the same network as your card’s issuing bank to reduce surcharge fees.

- Withdraw up to 15,000-20,000 rupees per transaction to stay within daily limits and avoid multiple fees.

- Check with your home bank about foreign transaction fees; many now offer fee‑free withdrawals up to a certain amount.

Some ATMs display a Currency Exchange Kiosk a service point inside banks or malls that sells foreign currency at near‑market rates. These can be useful if you need to swap leftover foreign notes for rupees.

How Much Cash Should You Carry?

There’s no one‑size‑fit‑all answer, but a practical rule of thumb works for most travelers:

- First two days: Carry 5,000-7,000 rupees in small notes for immediate needs.

- Weekly budget: Add another 10,000-12,000 rupees if you plan to visit smaller towns or use local transport.

- Emergency reserve: Keep a separate hidden pouch with 3,000-5,000 rupees that you only access if you lose your cards.

Always store cash in a zip‑lock bag or a money belt to protect it from humidity and pickpockets.

Alternative Back‑up Options

If you prefer not to carry a lot of paper money, consider these alternatives:

- Travel Card, a reloadable prepaid card (often Visa or Mastercard) that can be topped up online and used like a regular debit card. It bypasses foreign transaction fees on many Indian ATMs.

- Prepaid Debit Card, issued by Indian banks, it allows you to load foreign currency and withdraw rupees at local ATMs without additional conversion charges.

- Keep a Mobile Banking App, such as your bank’s official app, for instant balance checks and remote card freezes.

These tools give you a digital safety net while still letting you grab cash when needed.

Practical Checklist Before You Go

- Download at least one UPI app (Google Pay, PhonePe) and register using your Indian bank account if possible.

- Inform your bank about travel dates to avoid card blocks.

- Exchange a small amount (5,000-10,000 rupees) at a reputable bank or authorized kiosk before arrival.

- Mark the locations of ATMs in the cities you’ll visit (use Google Maps “ATM” filter).

- Pack a money belt, zip‑lock bags, and a hidden emergency pouch.

- Consider a travel prepaid card with a backup PIN stored separately.

Cash vs. Digital Payments: Quick Comparison

| Aspect | Cash | Digital Payments (UPI, Cards, Wallets) |

|---|---|---|

| Availability | Universal in rural & urban areas | Widely accepted in cities, limited in remote locations |

| Transaction Speed | Instant | Usually seconds, occasional network delays |

| Fees | None (aside from exchange rates) | Potential ATM surcharge, card processing fees |

| Security | Risk of loss or theft | Encrypted, can be frozen remotely |

| Tracking | Manual record‑keeping | Automatic transaction logs in apps |

Frequently Asked Questions

Do I need to exchange money at the airport?

Airport counters are convenient but often charge 4‑6% above the market rate. It’s better to exchange a small amount for immediate needs and then use ATMs or bank branches for larger sums.

Can I use my credit card everywhere?

Credit cards work well in hotels, major restaurants, and malls in big cities. In small towns, street markets, and many transport options, they are rarely accepted. Carry enough cash for those gaps.

What’s the safest way to keep cash?

Split cash into two places: a money belt under clothing and a hidden zip‑lock pouch in your luggage. Avoid keeping large sums in a single spot.

Are UPI apps available for foreign visitors?

Yes. If you open a non‑resident Indian bank account (NRE/NRO), you can link it to UPI. Some apps also let you add a foreign debit card for limited transactions, but full functionality usually requires an Indian mobile number.

How many rupees should I carry on a day trip to a village?

Around 2,000-3,000 rupees in small notes is sufficient for meals, local transport, and small purchases. Adjust upward if you plan to buy souvenirs.

Bottom line: you don’t need to hoard cash, but you do need enough to bridge the gaps where digital payments haven’t fully arrived. By mixing a modest amount of Indian rupees with a reliable UPI app, a low‑fee travel card, and a clear ATM strategy, you’ll stay flexible, safe, and ready for anything the diverse landscapes of India throw at you.